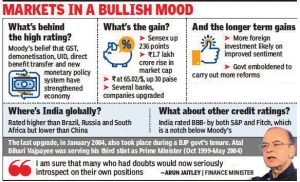

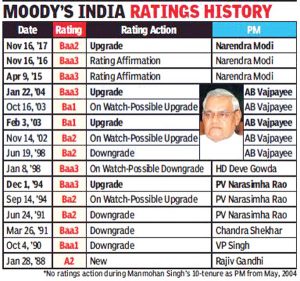

Global ratings agency Moody’s on November 17, 2017, revised the country’s sovereign ranking to Baa2 from Baa3 – its first upgrade in almost 14 years — citing implementation of a string of economic reforms, including demonetization and rollout of the goods and services tax. The new rating+, India’s highest since the 1991 reforms, comes as a huge boost for the government. The markets cheered, with the rupee, bonds and equities all reacting positively. The rupee and the Sensex gained over 1% intraday. The move comes close on the heels of the sharp improvement in India’s ranking in the World Bank’s ease of doing business survey.

The ratings upgrade by Moody’s could position India as an attractive investment destination, apart from making it easier for companies to raise resources abroad. The ratings agency highlighted reforms such as the Goods and Services Tax (GST) and demonetization, which it said would lead to greater formalization’ of the economy. Besides upgrading India’s ratings, Moody’s also revised the outlook from positive to stable, indicating that the next upgrade might take a while coming.

“The government is midway through a wide-ranging programme of economic and institutional reforms. While a number of important reforms remain at the design phase, Moody’s believes that those implemented to date will advance the government’s objective of improving the business climate, enhancing productivity, stimulating foreign and domestic investment, and ultimately fostering strong and sustainable growth,” the agency said.

The ratings action comes days ahead of the crucial Gujarat assembly elections where the opposition Congress has sought to portray GST and demonetisation as triggers for the slowdown. The Moody’s upgrade is expected to provide ammunition to the government to blunt criticisim about its handling of the economy after growth slowed to a three-year low of 5.7% in the June quarter and GST was criticised by the opposition.

Industry, stock brokers and bankers said the revised rating would accelerate fund flow to the country. “This move will now give India access to cheaper capital funds for investment, helping accelerate growth,” said MD & CEO, Axis Bank. So far India’s cohorts in the rating table were countries like South Africa and Indonesia. With this upgrade, India has moved into the same league as Italy, Spain, Oman and the Philippines.