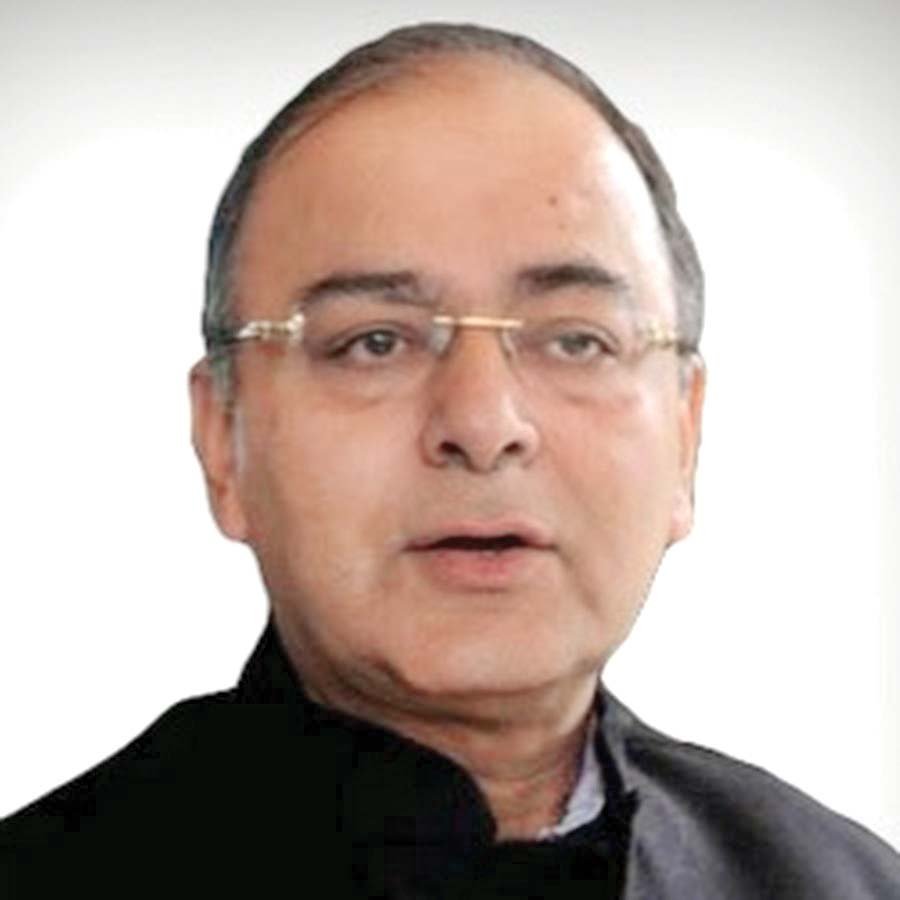

Synopsis of the speech delivered while moving the four GST bills in Lok Sabha by Union Minister of Finance & Corporate Affairs and Defence Shri Arun Jaitley on March 29. Highlighting the importance of the bills Shri Jaitley said that the law in offing would create a jurisdiction simultaneously both in the Centre and the States.

These are four important Bills and are being taken up together for consideration as their subject matters and references are same. The system of indirect taxes extant anterior to 101st amendment to the constitution continues to exist even today and is likely to continue till 15th September this year. Under this system, the right to levy some of the taxes was the jurisdiction of the Centre and the right to levy some of other taxes was under the jurisdiction of States. But these Bills seek to ensure the movement of all the goods and services all over India, to set up uniform system of taxation, facilitate the interface of an assessee with only one assessee authority. The tax proceeds, so collected, will be shared by both the Centre and the States. This system is somewhat different from the earlier one. It is different because we are now creating by law a jurisdiction simultaneously both in the Centre and the States and, in the process, handing over the indirect tax administration to the first federal institution that India has created where the Centre and the States both will participate. In this respect, the Goods and Services Tax Council made unanimous recommendations for five laws, out of which four laws will come up before the Parliament and one before the Legislative Assemblies of all the States and two Union Territories where Legislative Assembly exists. First law is the central GST law which includes the integration of taxes to be incurred on Goods and Services, determine the ceiling of taxation and collection of taxes etc. Second law is the SGST law which will not come up before the Centre but before 31 Legislative Assemblies.

This law will be a mirror image of the Central Law and will provide for as to how the GST will be implemented in every State. Third law is the Integrated GST which will handle the taxes likely to be incurred on the transactions of inter-state trades from one State to another State and from one Union Territory to the other Union Territory. Fourth is the Union Territory GST law which, in a way, stands to be the CGST law as it incorporates its provisions and implement them in the Union Territories. Fifth and the last one deals with the system under which provisions have been made to provide compensation to the State which suffers loss as a result of its implementation. A provision has been made for compensation cess in order to provide for compensation to such States which includes tax exceeding 28 per cent on the luxury items. Apart from this, the GST council is India’s first federal institution where sovereignty of the Centre and the States in relation to indirect taxes has been pooled together in a federal institution. Hence, to create India’s first federal institution, it is incumbent on all of us to make sure that the federal institution works. Therefore, I hope, we are guided to maintain that delicate balance of that relationship itself. With these few words, I commend these laws for the consideration of the House.