Stand Up India scheme has been completed six years of its inception. The scheme is one of the Modi government’s major initiatives, with the goal of ensuring prosperity for every stratum of society. On completing six years of the scheme, Prime Minister Shri Modi termed the initiative as part of the ongoing efforts to channel entrepreneurial spirit to further progress and prosperity in India. He said, ‘India is full of entrepreneurial energy, and the Stand Up India initiative is a part of the ongoing efforts to channelize this spirit to further progress and prosperity.’

Since its launch on 5th April 2016, above 30,160 crore rupees have been sanctioned to more than 1 lakh 33 thousand 995 account holders. Of the total sanctioned loans, more than 6,435 belong to ST borrowers with Rs 1373.71 crore sanctioned, and 19,310 accounts belonged to SC borrowers with Rs 3976.84 crore sanctioned. A total of 1,08,250 women entrepreneurs with totaling Rs. 24809.89 crore has been sanctioned. Women, scheduled castes, and scheduled tribes have access to loans ranging from 10 lakh to one crore rupees. According to available updated data, till the date of 7th April under the scheme, total sanctioned application was 135057 and total sanctioned amount was30395.78 Crore.

The scheme is inspired by the philosophy of ‘Antyodaya.’ Antyodaya is the Bharatiya Janata Party’s core foundational philosophy. Through the mission of Antyodaya, the BJP government is dedicated itself in the upliftment of the poorest of poor and deprived sections of society. That is why the scheme’s major goal is to foster entrepreneurship among underprivileged sections of society and turn them into job creators rather than job seekers. Women, Scheduled Castes (SC), and Scheduled Tribes (ST) are the focus of Stand Up India. It facilitates financial assistance ranging from Rs 10 lakh to Rs 1 crore to help them start their business. This financial assistance is available for greenfield enterprises (first-time projects/ventures) in manufacturing, services, or the trading sector, as well as sectors related to agriculture. As per the scheme, at least one beneficiary must be a woman per bank branch. It is also given to non-individual businesses. In this case, at least 51 percent of the enterprise’s shares or stakeholder must be SC/ST or woman.

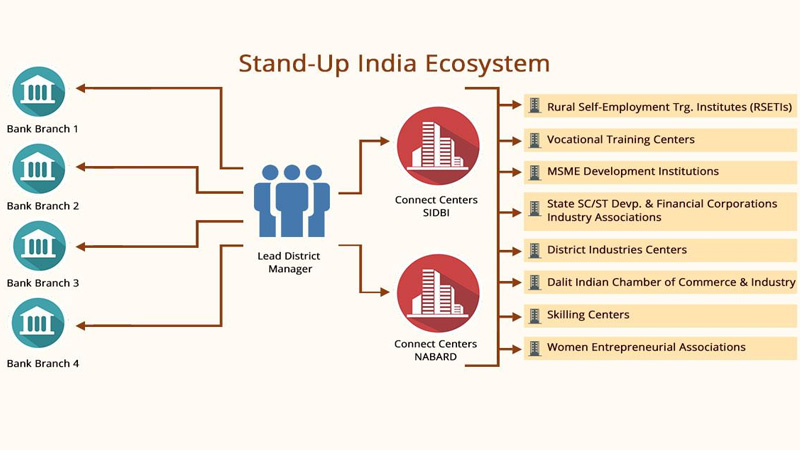

In the 2021-22 budget announcement, margin money for avail the loan under the scheme is reduced from up to 25 percent to up to 15percent of the project cost. In this announcement, activities allied to agriculture is also made eligible for the loan. The allied agriculture sector includes pisciculture, beekeeping, poultry, livestock, rearing, sorting,aggregation agro industries,dairy, fisheries, food agro-processing etc. 135518 branches of scheduled banks are connected with this stand Up india scheme and helping realizing the dream of last man of the society.

The Stand Up India scheme portal shared several success stories of entrepreneurs who, with the help of the scheme, listed themselves in emerging star in entrepreneurship. For example, Homemaker Turns Entrepreneur Mrs. Manasi Devi, a small businesswoman in Dhubri town, thought of starting a new business. Under the Stand Up India scheme, she got the help of 15 lakh and set up a factory for steel fabrication in Dhubri Town. She is currently providing direct employment to 15 people at a time. The store’s daily turnover ranges from 5000/- to 7000/ with approximately 3-4 work orders per day. Several such stories have been published on the portal, along with the contact information of entrepreneurs from disadvantaged backgrounds in our society who are contributing to the ‘Aatmbharat Abhiyan’ (self-reliant India campaign).